April 29, 2011 (Press-News.org) "Married Filing Jointly" is Not Always The Best Option

Most tax professionals would agree that "married filing jointly" is generally the most advantageous filing status. Spouses' incomes are combined, deductable expenses are pooled together and there are some benefits that are available only to joint filers.

While a joint return is typically how married couples file, what if you had recently become suspicious of your spouse and the source some of his or her income? What if your spouse had been making millions or even billions from a Ponzi scheme he or she was running and you did not know it? Then what if the house of cards came crashing down and the Internal Revenue Service (IRS) came looking for the unpaid tax on all of that ill-gotten money?

The premise of this story likely sounds vaguely familiar and certainly far-fetched for most couples; however, the principle is applicable to all. Even in denominations of thousands instead of millions or billions, the illegal actions of one spouse can have negative tax consequences on both spouses.

When a couple files a joint tax return, they automatically become joint and severally liable for any tax delinquencies. That essentially means that regardless of which spouse is truly responsible for the delinquency, the IRS can and will come after both spouses named on a joint return. That is true even if the couple later divorces.

Benefit of Filing a Separate Tax Return

One way of avoiding a spouse's tax liabilities is to file a "married filing separately" return. Unfortunately, this will often result in higher taxes for both spouses. Moreover, separate filings can limit or eliminate some benefits and deductions. Nevertheless, the extra tax could be considered insurance against an even higher tax liability if something is awry and the IRS comes knocking.

If, despite one spouse's suspicions about the other, a couple decides to file a joint return, it is wise for both to know and understand what is being claimed. Naivety is not bliss in this situation and it is wise to review any return before blindly signing. If something seems "off," one should not sign and should consider approaching the separate filing issue (as awkward as that conversation might be).

Filing Status During a Divorce

Divorce is another time when a spouse should not be naive about the contents of a joint tax return. Because trust is likely at an all-time low as a marriage ends, it would be wise to ask a tax professional to independently review the filings and documentation to avoid any unnecessary tax liability. The IRS allows the "innocent spouse" in few cases.

There also arises the question of how a divorcing couple should file their taxes: married filing jointly, married filing separately or single status. A couple's marital status on December 31 governs the filing status for that entire year. If the divorce is finalized as of December 31, each spouse must file a single tax return regardless of how much of the year the couple lived together.

If a divorcing couple is still legally married on December 31, the spouses must file as married (jointly or separately). However, if a still married spouse meets the following criteria, he or she may be able to file under Head of Household status:

-Unmarried or considered unmarried (legally separated or spouse did not live in home for last six months) on December 31; and

-Paid more than half of costs to maintain home; and

-Housed a child (for whom either spouse can claim as an exemption) for more than half the year

Because each couple's financial situation is different, each spouse must decide which filing status is most financially advantageous for them.

Other Tax Considerations in Divorce

While there is a tendency to want to negotiate and finalize a divorce quickly, each spouse should take a step back and consider the tax implications of any agreements to divide assets. Issues such as the capital gains on the sale of certain assets, alimony payments instead of child support, claiming exemptions for the children and claiming child care credits.

Seek Professional Help

Each marriage and its financial situation are unique. While filing a joint tax return with a spouse is generally the most advantageous route, there are circumstances where a spouse may need to protect himself or herself from the actions of their counterpart. Couples filing jointly will be pursued by the IRS jointly if there are taxes owed, regardless of which spouse is to blame.

During a divorce is another time a spouse should take a strategic look at what type of tax return to file and how the marital assets are going to be divided. Because all of these situations are complex, contact a knowledgeable tax and family law professional to discuss your circumstances. If you have additional tax questions, attorney Francis Grather can direct you to a qualified professional to provide sound tax advice.

Article provided by Broderick, Newmark & Grather, P.C.

Visit us at www.bnglawyers.com

"Married Filing Jointly" is Not Always The Best Option

Most tax professionals would agree that "married filing jointly" is generally the most advantageous filing status. Learn more about how this process can help (or hurt) you during tax season, especially in the midst of a divorce.

2011-04-29

ELSE PRESS RELEASES FROM THIS DATE:

Iowa State chemist designs new polymer structures for use as 'plastic electronics'

2011-04-29

AMES, Iowa – Iowa State University's Malika Jeffries-EL says she's studying doing structure-property studies so she can teach old polymers new tricks.

Those tricks improve the properties of certain organic polymers that mimic the properties of traditional inorganic semiconductors and could make the polymers very useful in organic solar cells, light-emitting diodes and thin-film transistors.

Conductive polymers date back to the late 1970s when researchers Alan Heeger, Alan MacDiarmid and Hideki Shirakawa discovered that plastics, with certain arrangements of atoms, can ...

Stripping a Second Mortgage in a Chapter 13 Bankruptcy

2011-04-29

Stripping a Second Mortgage in a Chapter 13 Bankruptcy

One of current problems in the real estate market is the number of "underwater" mortgages, where the value of the properly has declined below the outstanding value of the mortgage. Banks have been extraordinarily resistant to the concept of loan modifications, where that modification would lower the principal value of the loan and bring it in line with the market value.

Most people are trapped in these houses, as they cannot sell them for a high enough price to allow them to pay off the mortgage. The ...

A tale of 2 lakes: One gives early warning signal for ecosystem collapse

2011-04-29

Researchers eavesdropping on complex signals from a remote Wisconsin lake have detected what they say is an unmistakable warning--a death knell--of the impending collapse of the lake's aquatic ecosystem.

The finding, reported today in the journal Science by a team of researchers led by Stephen Carpenter, an ecologist at the University of Wisconsin-Madison (UW-Madison), is the first experimental evidence that radical change in an ecosystem can be detected in advance, possibly in time to prevent ecological catastrophe.

"For a long time, ecologists thought these changes ...

Missouri elk are being reintroduced in the wrong part of the state, MU anthropologist says

2011-04-29

According to prehistoric records, elk roamed the northwestern part of Missouri until 1865. Now, the Missouri Department of Conservation is planning to reintroduce elk, but this time in the southeast part of the state. While a University of Missouri anthropologist believes the reintroduction is good for elk, tourism and the economy, he said the effort may have unintended negative consequences that are difficult to predict.

R. Lee Lyman, the chair of Anthropology in the College of Arts and Science, has studied the history of mammals, conservation biology and wildlife management ...

Teenage Texting: A Roadway Danger

2011-04-29

Teenage Texting: A Roadway Danger

Distracted driving takes a heavy toll on our nation's highways: according to National Highway Traffic Safety Administration data, over 5,000 motorists are killed every year in crashes that involve driver distraction. Texting while driving is an especially dangerous form of distraction, as it involves taking your hands off the wheel, your eyes off the road and your mind off of driving. Teens are not only more likely to text, they are also more inexperienced behind the wheel: drivers under the age of 21 are involved in three times as many ...

TRMM Satellite sees massive thunderstorms in severe weather system

2011-04-29

The Tropical Rainfall Measuring Mission or TRMM satellite again flew over severe thunderstorms that were spawning tornadoes over the eastern United States on April 28 and detected massive thunderstorms and very heavy rainfall.

TRMM, a satellite managed by both NASA and the Japanese Space Agency, captured the rainfall rates occurring in the line of thunderstorms associated with a powerful cold front moving through the eastern U.S. on April 28. TRMM flew over the strong cold front and captured data at 0652 UTC (2:52 AM EDT) on April 28, 2011. Most of the rainfall was occurring ...

Rent Regulation Bill Advances Through New York State Assembly

2011-04-29

Rent Regulation Bill Advances Through New York State Assembly

Rent regulation law or rent law, a staple in the real estate landscape of New York City, has been eroding in recent years. Established after World War II, rent laws cap the amount of rent a landlord can collect for a particular rental unit. More than 300,000 affordable apartments have been reclassified as landlords exploit loopholes to charge more for rent under the old regulations.

Legislative Activity

Amidst concerns that the city is becoming increasingly unaffordable, lawmakers in the state Assembly ...

Alcohol, mood and me (not you)

2011-04-29

Thanks in part to studies that follow subjects for a long time, psychologists are learning more about differences between people. In a new article published in Current Directions in Psychological Science, a journal of the Association for Psychological Science, the author describes how psychologists can use their data to learn about the different ways that people's minds work.

Most psychology research is done by asking a big group of people the same questions at the same time. "So we might get a bunch of Psych 101 undergrads, administer a survey, ask about how much they ...

California Is One of the Deadliest States for Pedestrians

2011-04-29

California Is One of the Deadliest States for Pedestrians

Motor vehicle collisions involving pedestrians can happen in an instant: when a pedestrian steps off the curb, drivers inattentive to the crossing have only moments to react. Although pedestrian fatalities have actually been on the decline over the last decade, the number is still disturbingly high.

According to National Highway Traffic Safety Administration figures, 4,092 people died in 2009 in pedestrian accidents. Nonfatal pedestrian injuries are even more common: approximately 59,000 were recorded in 2009 ...

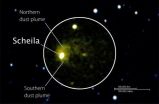

NASA's Swift and Hubble probe asteroid collision debris

2011-04-29

Late last year, astronomers noticed an asteroid named Scheila had unexpectedly brightened, and it was sporting short-lived plumes. Data from NASA's Swift satellite and Hubble Space Telescope showed these changes likely occurred after Scheila was struck by a much smaller asteroid.

"Collisions between asteroids create rock fragments, from fine dust to huge boulders, that impact planets and their moons," said Dennis Bodewits, an astronomer at the University of Maryland in College Park and lead author of the Swift study. "Yet this is the first time we've been able to catch ...

LAST 30 PRESS RELEASES:

$3 million NIH grant funds national study of Medicare Advantage’s benefit expansion into social supports

Amplified Sciences achieves CAP accreditation for cutting-edge diagnostic lab

Fred Hutch announces 12 recipients of the annual Harold M. Weintraub Graduate Student Award

Native forest litter helps rebuild soil life in post-mining landscapes

Mountain soils in arid regions may emit more greenhouse gas as climate shifts, new study finds

Pairing biochar with other soil amendments could unlock stronger gains in soil health

Why do we get a skip in our step when we’re happy? Thank dopamine

UC Irvine scientists uncover cellular mechanism behind muscle repair

Platform to map living brain noninvasively takes next big step

Stress-testing the Cascadia Subduction Zone reveals variability that could impact how earthquakes spread

We may be underestimating the true carbon cost of northern wildfires

Blood test predicts which bladder cancer patients may safely skip surgery

Kennesaw State's Vijay Anand honored as National Academy of Inventors Senior Member

Recovery from whaling reveals the role of age in Humpback reproduction

Can the canny tick help prevent disease like MS and cancer?

Newcomer children show lower rates of emergency department use for non‑urgent conditions, study finds

Cognitive and neuropsychiatric function in former American football players

From trash to climate tech: rubber gloves find new life as carbon capturers materials

A step towards needed treatments for hantaviruses in new molecular map

Boys are more motivated, while girls are more compassionate?

Study identifies opposing roles for IL6 and IL6R in long-term mortality

AI accurately spots medical disorder from privacy-conscious hand images

Transient Pauli blocking for broadband ultrafast optical switching

Political polarization can spur CO2 emissions, stymie climate action

Researchers develop new strategy for improving inverted perovskite solar cells

Yes! The role of YAP and CTGF as potential therapeutic targets for preventing severe liver disease

Pancreatic cancer may begin hiding from the immune system earlier than we thought

Robotic wing inspired by nature delivers leap in underwater stability

A clinical reveals that aniridia causes a progressive loss of corneal sensitivity

Fossil amber reveals the secret lives of Cretaceous ants

[Press-News.org] "Married Filing Jointly" is Not Always The Best OptionMost tax professionals would agree that "married filing jointly" is generally the most advantageous filing status. Learn more about how this process can help (or hurt) you during tax season, especially in the midst of a divorce.