LONDON, ENGLAND, August 19, 2011 (Press-News.org) - Consumer confidence in decline. Consumers' sentiment was adversely affected by the wider economy, inflation fears and their own financial situation for a third consecutive month.

- Stretched consumers are increasingly looking to savings to help make ends meet. The amount of consumers on the tightest budgets who say they are dipping into their savings increased further in July, the highest it has been this year.

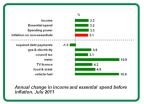

- Weaker income growth is hitting spending power. Incomes continue to fall in real terms down 1.8% in July compared with a year earlier.

- Growth in essential spending remained unchanged from the previous month at 3.2%. However, concerns about further price rises in gas and electricity are contributing to the increasing worries consumers have about further falls in spending power due to the rising cost of essential items.

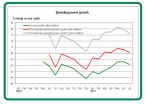

Spending power growth falls back in July

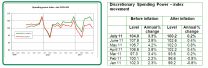

Discretionary spending power after inflation has stalled over the past two months and fell back to 0.2% year on year growth in July, according to the latest Lloyds TSB Spending Power Report. This follows an upward trend throughout the first half of the year, when spending power growth improved by 1.6% points in five months.

Spending power is growing strongly in nominal terms. However with inflation on non-essentials above 3%, in real terms it was broadly flat in July. The GBP30 additional spending power available in July reduces to less than GBP2 once inflation is taken into account.

Patrick Foley, chief economist at Lloyds TSB, says:

"Spending power stalled in July after the strong upward trend over the first half of the year. The improvement in household incomes, albeit from a very low starting point, was largely driven by growth in employment and the latest data is likely to reflect a softening in jobs growth in July.

"Looking ahead, the anticipated gas and electricity price increases will put upward pressure on essential spending. Without offsetting reductions in inflation elsewhere or further improvements in employment, it is unlikely that spending power will improve significantly in the near term."

Consumer confidence low as savings are used to cover essential spend

Weakening spending power growth is reflected in consumer confidence, which has steadily decreased over the past few months. Concern at the financial situation of the country, which remains extraordinarily high at 92% of respondents, and consumers' own finances are weighing on sentiment.

At the same time, the balance of those finding money is tight and those who do not have enough to meet monthly outgoings is starting to shift. One in ten consumers currently do not have enough to meet monthly outgoings, rising to 14% for those aged between 35 to 44, a 5% point increase in July.

With money increasingly tight it appears more of those who use all their income to cover essential spending are dipping into their savings to get through the month. This figure rose 4% points in July to one in six (17%). Though not a significant increase, this is the highest this figure has been all year.

Mike Regnier, director of current accounts for Lloyds TSB, comments:

"With an increasing amount of negative news flow around price rises in the last month it is not surprising that this has fed through to consumer confidence. However, it is also clear that consumers are feeling the squeeze on their spending power. More consumers didn't have enough to make ends meet, and as a result they are having to dip into their savings to get through the month."

Income growth weakens and inflation worries increase

Weak income growth had the greatest impact on spending power. Incomes have been falling in real terms for well over a year, and the annual growth rate fell back further in July to 1.8%. Weakening income growth is an indication that employment is not growing as quickly as it was in the first half of the year.

Annual growth in essential spending was unchanged at 3.2% in July. This reflected an easing in inflationary pressure and the continuing reduction in required debt repayments over the past year. The latter effect has been steadily dwindling in recent months. Required debt payments fell 1.3% in July, compared to 4.7% in January.

The prospect of debt payments stabilising combined with price rises for gas and electricity still to come into effect, means that the likelihood is essential spending is set to rise in the near term. Unsurprisingly, this fear is reflected in consumers' feelings about inflation. 89% of respondents are now worried about current levels of inflation, up from 85% in June. A higher proportion of these believe it is not at all good, rising 4% points last month to 34%. An increasing proportion of 30 to 34 years olds believe the current level of inflation is worrying, up 6% points to 91%.

The main inflationary concern is gas and electricity prices, which received a lot of attention in July following further price rise announcements from the main utility companies. The number concerned about rising prices in this area increased by 7% points in July to 84%. This was closely followed by food prices at 82%.

Expectations have worsened

Consumers' outlook deteriorated in July. More respondents (29% up from 26%) felt they will have less money in six months time, largely driven by the worries over increasing household bills.

The proportion of respondents who believe they will have less spending power in six months time increased across nearly all regions with the biggest change seen in Scotland (18% to 32%), with the most concerned region being the South West, at 37%. There were also deteriorations in prospects amongst those aged 35 and above, increasing 4% points to 23%.

Notes to Editors:

The Lloyds TSB Spending Power Report examines trends in consumers' spending power, defined as income left after essential spending. Each month it covers both changes in actual spending power and in consumers' perceptions, as well as recording how consumers are reacting. The Spending Power Report measures payments into Lloyds TSB current accounts and subtracts essential spending - rent, mortgage and debt payments, utility bills, council tax, TV licences, food and fuel. Additionally, 2,000 consumers are asked about their current and future spending habits and how their commitments affect their spending power.

The index is derived from the current account data of all Lloyds TSB customers, the largest provider of current accounts in the UK. This provides a robust and representative sample of the entire UK market.

Website: http://www.lloydstsb.com

Lloyds TSB Spending Powere Report - Consumer Confidence Declines as Spending Power Growth Stalls

Spending power growth stalled in July. After inflation, discretionary spending power grew by only 0.2% from a year earlier, equating to an increase of less than GBP2 in spending power

2011-08-19

ELSE PRESS RELEASES FROM THIS DATE:

Benefits of Guided Meditation are Immediate for Those New to Meditation

2011-08-19

Recent studies have found that guided meditation can lower blood pressure, reduce fatigue and help a person control stress levels. And while recent studies have focused on mindfulness meditation, many different forms of meditation can provide health benefits. Richard Nongard, a Certified Meditation Instructor and the author of the book Medical Meditation, says the Internet is providing a new forum for more people to learn meditation than ever before. For those new to meditation, the benefits are immediate and even short 2-3 minute meditations can produce profound results.

Nongard ...

Mirage 9 Studios, LLC Announces Launch of its Newest Online Store Featuring the Latest Dynamic Imaging Technology

2011-08-19

Mirage 9 Studios, LLC announced today the upcoming launch of a network of new sites that will offer clients high-tech dynamic imaging solutions to the consumer market place. These new sites will bring a robust and creative solution to the home or business Internet product shoppers for the web-to-print industry. Mirage 9 Studios, LLC has formerly been recognized as a industry leader in product photography and print marketing solutions in the local Dallas/Forth Worth area. However, over the past few years they have transitioned their focus into the online print media industry ...

MemphisInvest.com Provides Foreign Real Estate Investors with a Welcome Environment in Memphis, Tennessee

2011-08-19

With a new, business-minded mayor and administration, Memphis government and civic leaders have been working diligently for the past two years to improve the image of Memphis and emphasize to the world that Memphis is indeed a world class city and should be a "first choice" city for foreign business. With recent announcements from foreign-based companies of their intentions to relocate facilities, production, jobs and headquarters to Memphis, the hard work would appear to be paying off for the city. There is however, one more indicator that is pointing to a very ...

BookWhirl.com Offers Permanent 100% Royalties

2011-08-12

BookWhirl.com, one of the leading providers of affordable book marketing services, announces the launch of the Happily Ever After Promo, featuring two of the most effective marketing resource, the E-mail Marketing Campaign and the e-Bookshelf. The Happily Ever After Promo rewards self-published authors permanent 100% royalties.

A self-published book's web presence is vital to a successful marketing campaign, BookWhirl.com now offers the Happily Ever After to help authors promote their books through e-mail marketing and e-book selling. Clients can enjoy from 1 up to 10 ...

The Business Software Directory, Buissy.com, Releases V0.93, Now With Product Filtering

2011-08-12

The best place where to find software, Buissy.com, has released version 0.93 of the business software directory. The major additional functionality is a remodelled search engine, to make it even easier to find what you are looking for, as well as a product filter to enable purchasers to search for specific functionality, languages, country representation and price models.

To encourage software vendors to modify information and add news and release information, Buissy.com is now putting the last changed product in the top of the list, both on the first page as well as ...

NFL's Famed Drew Pearson talks Denzel Washington on the "My Crew Magazine Radio Show" with popular host Kim Kelly

2011-08-12

One of the NFL's most famous Wide Receivers of all time, Drew Pearson joined the world-wide popular radio program the "My Crew Magazine Show" that caters to a young 18-35 hip urban crowd, August 4, 2011 and now available on Podcast. Pearson appeared on the Blog Talk Radio's show "3rd Annual NFL Kick Off Show" (http://www.blogtalkradio.com/my-crew-magazine) with host Kim Kelly that airs every Thursday night around the globe at 7 PM Pacific, and 11 pm Eastern. The exclusive interview featured Pearson who has appeared in Super Bowls X, XII, XIII, Selected ...

Shanghai Marriott Hotel Hongqiao Welcomes Suede

2011-08-12

English alternative rock band Suede stayed at Shanghai Marriott Hotel Hongqiao during their concert in Shanghai, and received a warmly welcome from General Manager James Macadie (3rd from right), Director of Room Jason Farnworth (right) and Director of Marketing Joan Xu (left).

Suede, an early glam rock band formed in 1989, performed at Shanghai Grand Stage, bringing their most popular works from their heyday before they went their separate ways in 2003.

After a seven-year absence, the five-member band announced late last year that they would get together for a ...

Down The Rabbit Hole

2011-08-12

"Wonder of wonders, this native New Yorker's debut CD sounds legitimately more jazzy than folky---smack-dab in the Laura Nyro/Ricki Lee Jones/Sophie B. Hawkins."

- Chuck Eddy, The Village Voice

"A singer with a sultry voice."

-Marc Santora, The New York Times

Alternatively intense and playful songwriter/pianist Allison Tartalia, of Allison's Invention about to release her EP Sweet and Vicious. Tartalia's sultry voice and honest, raw lyrics heat up this already baking weather."

-The Deli, NYC

"Trying to pin down Emmy-nominee Allison ...

Klarquist Sparkman to speak at 4th Protein Discovery & Therapeutics Meeting Oct 19-21 in San Diego

2011-08-12

Susan Alpert Siegel Ph.D. and William D. Noonan M.D. of Klarquist Sparkman to give a featured presentation entitled "Patenting Protein Therapeutics: In the Shadow of Uncertainty" at GTC's 4th Protein Discovery & Therapeutics Conference on Oct 19-21, 2011 in San Diego, CA

Dr's Siegel and Noonan will discuss how therapeutic proteins are patented in a purified, synthetic or artificial form to distinguish them from unpatentable products of nature. Patentable proteins must also be new, useful and nonobvious. As patents expire on antibodies, patent strategies ...

Donna Preiss of The Preiss Company to Participate in Bisnow's Power Women of Atlanta Summit

2011-08-12

The Preiss Company, one of the largest student housing providers in the nation, is pleased to announce that company founder and CEO, Donna Preiss, will be participating in the upcoming Power Women of Atlanta summit presented by Bisnow. The event will occur on Friday, August 19th at the Grand Hyatt Atlanta Buckhead.

Bisnow (www.bisnow.com) consists of twenty daily e-newsletters focused on business niches in Atlanta, Baltimore, Boston, Charlotte, Chicago, Dallas-Fort Worth, DC, Houston, Los Angeles, National, New York, and South Florida. Today, the company is the best ...

LAST 30 PRESS RELEASES:

Scientists reveal our best- and worst-case scenarios for a warming Antarctica

Cleaner fish show intelligence typical of mammals

AABNet and partners launch landmark guide on the conservation of African livestock genetic resources and sustainable breeding strategies

Produce hydrogen and oxygen simultaneously from a single atom! Achieve carbon neutrality with an 'All-in-one' single-atom water electrolysis catalyst

Sleep loss linked to higher atrial fibrillation risk in working-age adults

Visible light-driven deracemization of α-aryl ketones synergistically catalyzed by thiophenols and chiral phosphoric acid

Most AI bots lack basic safety disclosures, study finds

How competitive gaming on discord fosters social connections

CU Anschutz School of Medicine receives best ranking in NIH funding in 20 years

Mayo Clinic opens patient information office in Cayman Islands

Phonon lasers unlock ultrabroadband acoustic frequency combs

Babies with an increased likelihood of autism may struggle to settle into deep, restorative sleep, according to a new study from the University of East Anglia.

National Reactor Innovation Center opens Molten Salt Thermophysical Examination Capability at INL

International Progressive MS Alliance awards €6.9 million to three studies researching therapies to address common symptoms of progressive MS

Can your soil’s color predict its health?

Biochar nanomaterials could transform medicine, energy, and climate solutions

Turning waste into power: scientists convert discarded phone batteries and industrial lignin into high-performance sodium battery materials

PhD student maps mysterious upper atmosphere of Uranus for the first time

Idaho National Laboratory to accelerate nuclear energy deployment with NVIDIA AI through the Genesis Mission

Blood test could help guide treatment decisions in germ cell tumors

New ‘scimitar-crested’ Spinosaurus species discovered in the central Sahara

“Cyborg” pancreatic organoids can monitor the maturation of islet cells

Technique to extract concepts from AI models can help steer and monitor model outputs

Study clarifies the cancer genome in domestic cats

Crested Spinosaurus fossil was aquatic, but lived 1,000 kilometers from the Tethys Sea

MULTI-evolve: Rapid evolution of complex multi-mutant proteins

A new method to steer AI output uncovers vulnerabilities and potential improvements

Why some objects in space look like snowmen

Flickering glacial climate may have shaped early human evolution

First AHA/ACC acute pulmonary embolism guideline: prompt diagnosis and treatment are key

[Press-News.org] Lloyds TSB Spending Powere Report - Consumer Confidence Declines as Spending Power Growth StallsSpending power growth stalled in July. After inflation, discretionary spending power grew by only 0.2% from a year earlier, equating to an increase of less than GBP2 in spending power