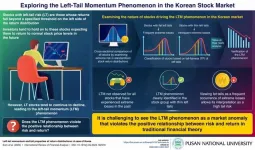

PNU researcher investigates left-tail momentum in the Korean stock market

The phenomenon is driven by investors overestimating the expected returns for stocks exhibiting large losses

2023-07-19

(Press-News.org) Left-tail risk (LT) stocks are those whose returns fall into the extreme end on the left side of the return distribution. In the hopes of mean-reverting to the normal price, investors usually hold on to these stocks. However, contrary to mean-reverting expectations, these stocks that have experienced extreme losses and high tail risks in the past tend to continue declining in the future, resulting in financial losses. This phenomenon, referred to as left-tail momentum (LTM), appears to challenge the traditional notion of a positive relationship between risk and return.

To investigate this market anomaly, a team of researchers, led by Prof. Eom from the School of Business at Pusan National University in South Korea, have recently re-verified the LTM phenomenon in the Korean stock markets through a cross-sectional comparison of all stocks by examining extreme risk situations. Their work was made available online on 10 February 2023 and published in Volume 87 of the International Review of Financial Analysis journal on 01 May 2023.

The researchers analyzed stock returns from July 2000 to June 2021 and standardized the distributions of these returns to cross-sectionally compare all stocks in the same criterion. By aligning the returns of all stocks within a predetermined threshold, they established a fair basis for comparing risks across different stocks. Their analysis revealed two types of LT stocks: those with fatter tails, reflecting higher tail risk and more frequent extreme losses, and those with thin tails, indicating relatively low tail risk and infrequent extreme losses.

The researchers then proceeded to investigate the LTM phenomenon within these groups by utilizing a measure called Value-at-Risk (VaR), which represents the boundary value associated with a specific probability in the distribution of stock returns. By utilizing VaR, they were able to assess the magnitude of potential financial losses, taking into consideration the tail-fatness property of the stock return distributions.

They found that the LTM phenomenon is not observed for all stocks that have experienced extreme losses in the past, but rather only for stocks with thin tails—stocks that have lower tail risk and have experienced extreme losses infrequently in the past. These results challenge previous assumptions, demonstrating that the LTM phenomenon does not contradict the conventional positive relationship between risk and return.

“If the fat tail property is viewed as a frequent occurrence of extreme losses, it can be interpreted as a high tail risk. Since LTM phenomenon was clearly observed only in stocks with a thin tail distribution, it is difficult to see it as evidence that violates the positive relationship between risk and return in traditional financial theory,” emphasize the researchers.

Overall, the research reveals that the LTM phenomenon is driven by investors overvaluing stocks with low left-tail risks compared to those with high left-tail risks. “This study looks forward to an interesting discourse in further studies investigating whether the LTM phenomenon that involves a low left-tail risk can be explained in terms of the risk–return trade-off relationship,” conclude the researchers.

***

Reference

DOI: https://doi.org/10.1016/j.irfa.2023.102570

About the institute

Pusan National University, located in Busan, South Korea, was founded in 1946, and is now the no. 1 national university of South Korea in research and educational competency. The multi-campus university also has other smaller campuses in Yangsan, Miryang, and Ami. The university prides itself on the principles of truth, freedom, and service, and has approximately 30,000 students, 1200 professors, and 750 faculty members. The university is composed of 14 colleges (schools) and one independent division, with 103 departments in all.

Website: https://www.pusan.ac.kr/eng/Main.do

About the authors

Cheoljun Eom is a professor at the School of Business at Pusan National University in South Korea. He was a postdoctoral researcher at Pohang University of Science and Technology (POSTECH) from 1999–2000, and worked in Hyundai Investment and Security Co. Ltd. as a manager from 2001–2002, where he developed the total asset allocation system. His research interests include asset pricing, portfolio optimization, financial econometrics, and econophysics. He has published more than 90 papers in the field of Finance and Interdisciplinary Science. After winning an award of 2009 Best Researcher in Pusan National University, he has received a few research excellence awards, and recently won the Korea Financial Investment Association Outstanding Paper Award at the 2023 joint conference with the Allied Korea Finance Associations.

Google Scholar website: https://scholar.google.com/citations?user=zEVhXPEAAAAJ&hl=en

ORCID id: 0000-0001-6362-9947

Yunsung Eom is a professor at the School of Business at Hansung University in Seoul, South Korea. He graduated from the Department of Fine Arts and the Department of Business Administration at Seoul National University and also obtained his master's and doctoral degrees in Finance there. He has conducted research as a visiting scholar at the University of Washington and the Economic Research Institute, Bank of Korea. His research interests include behavioral finance, market microstructure, investments, and algorithmic trading. His most cited research is “The disposition effect and investment performance in the futures market,” which is published in the Journal of Futures Markets in 2009.

Google Scholar website: https://scholar.google.com/citations?hl=en&user=M443k0EAAAAJ

Jong Won Park has been a professor of Finance at the College of Business at the University of Seoul since 2005. Before joining UOS, Professor Park was an assistant and associate professor at the College of Business at Cheju National University. He obtained his Ph.D. in Finance from Seoul National University in March 1995. His research interests focus on empirical asset pricing, market volatility, capital markets and anomalies, derivatives/risk management, retirement and public pension, corporate finance, market regulation, and macro-finance.

Google Scholar website: https://scholar.google.com/citations?hl=en&user=6qUbCb0AAAAJ&view_op=list_works&sortby=pubdate

END

[Attachments] See images for this press release:

ELSE PRESS RELEASES FROM THIS DATE:

2023-07-19

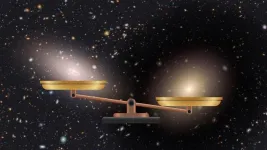

A team of scientists, led by the researcher at the IAC and the University of La Laguna (ULL) Sebastién Comerón, has found that the galaxy NGC 1277 does not contain dark matter.This is the first time that a massive galaxy (it has a mass several times that of the Milky Way) does not show evidence for this invisible component of the universe. “This result does not fit in with the currently accepted cosmological models, which include dark matter” explains Comerón.

In the current standard model cosmology massive galaxies contain substantial quantities of dark matter, a type of matter which does not interact in the same ...

2023-07-19

Finding sustainable and clean fuels is crucial in today’s global energy and climate crisis. One promising candidate that is increasingly gaining relevance is hydrogen. However, today’s industrial hydrogen production still has a considerable CO2 footprint, especially considering processes like steam reforming or non-sustainable electrolysis.

A team led by Prof. Dominik Eder from the Institute of Materials Chemistry (TU Wien) is therefore focusing on the development of environmentally friendly processes for obtaining hydrogen, for example by photocatalysis. This process enables the conversion of ...

2023-07-19

Biomass, mainly composed of lignocellulose and vegetable oil, has been acclaimed as one of the most promising sustainable sources of raw carbon material for the synthesis of transport fuels and value-added chemicals. The catalytic conversion of lignocellulose/vegetable oil and their related derivatives has attracted great attention in biomass valorization. Many elegant methods including hydrolysis, dehydration, hydrogenation, hydrogenolysis, oxidation, etherification, esterification, amination, aldol condensation, ...

2023-07-19

When raindrops fall from the sky, they can produce a small amount of energy that can be harvested and turned into electricity. It is a small-scale version of hydropower, which uses the kinetic energy of moving water to produce electricity. Researchers have proposed that the energy collected from raindrops could be a potential source of clean, renewable power. However, this technology has been difficult to develop on a large scale, which has limited its practical application.

To collect raindrop energy, a device called a triboelectric ...

2023-07-19

Homologous recombination (HR) is an important process that plays multiple crucial roles during meiosis, a type of cell cycle dedicated to sexual reproduction. During HR, homologous DNA molecules exchange their genetic material. During the meiotic prophase, DNA are clipped throughout the genome, forming numerous DNA double-strand breaks. Such DNA breaks attract homologous recombination enzymes, which promote pairing of homologous chromosomes.

Dmc1 is one such meiosis-specific recombinase in eukaryotes (organisms that have a clearly defined nucleus), ...

2023-07-19

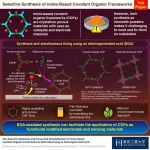

Covalent organic frameworks (COFs) are versatile materials composed of interconnected organic molecules held together by covalent bonds. These frameworks can be constructed in two-dimensional or three-dimensional (3D) forms which possess a unique combination of low density, high surface area, and easily tunable properties. Among the various types of COFs, imine-linked COFs have garnered considerable attention owing to their exceptional thermal and chemical stability as well as their broad scope of monomeric starting materials.

However, traditional bulk synthetic methods for COFs often yield powders that are insoluble ...

2023-07-19

As necessary as cooling technologies are, we’re still operating on an outdated technology that can be considered a significant contributor to global warming and greenhouse gas emissions. Currently, vapor compression cycle-based cooling (VCC) is the standard for reliable cooling of air conditioning and refrigeration, but by switching to electrocaloric cooling (EC) researchers are hoping to create a more environmentally friendly, scalable and compressor-free method of cooling to benefit businesses, families and the environment.

The researchers published their work in iEnergy on ...

2023-07-19

(Toronto July 19, 2023) Fully open access publisher JMIR Publications has acquired the Online Journal of Public Health Informatics (OJPHI), expanding its portfolio to 35 gold open access journals. This acquisition marks an open access milestone in JMIR Publications’ continued mission to keep openness at the heart of what it does.

Indexed in PubMed Central, OJPHI has been delivering the latest developments in the emerging field of public health informatics since 2009. The journal publishes research articles, book reviews, technology reviews, working papers, interviews, commentaries, and handpicked student capstone projects.

All ...

2023-07-19

JMIR Medical Education (2023 Impact Factor 5.2) and Guest Editors: Amir Tal, PhD, and Oren Asman, LLD welcome submissions to a special theme issue examining "Responsible Design, Integration, and Use of Generative AI in Mental Health"

This special theme issue aims to unite various stakeholders in exploring the responsible use of generative artificial intelligence (GAI) within the mental health domain. The goal is to curate a collection of articles that examine the advantages, challenges, and potential risks associated with deploying GAI models ...

2023-07-19

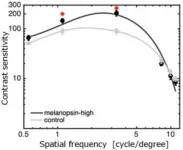

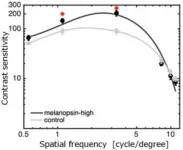

Prof Sei-ichi Tsujimura of the Nagoya City University and Prof Su-Ling Yeh of National Taiwan University and Kagoshima University, have discovered that our visual acuity (contrast sensitivity) can be improved by using a light with a special spectrum that can selectively stimulate melanopsin cells in the retina.

Background

The retina of our eye contains cone photoreceptor cells, which identify colors in bright environment, and rod photoreceptor cells, which work in the dark. It has long been thought that humans see and identify objects by these two types of photoreceptor cells alone. ...

LAST 30 PRESS RELEASES:

[Press-News.org] PNU researcher investigates left-tail momentum in the Korean stock market

The phenomenon is driven by investors overestimating the expected returns for stocks exhibiting large losses